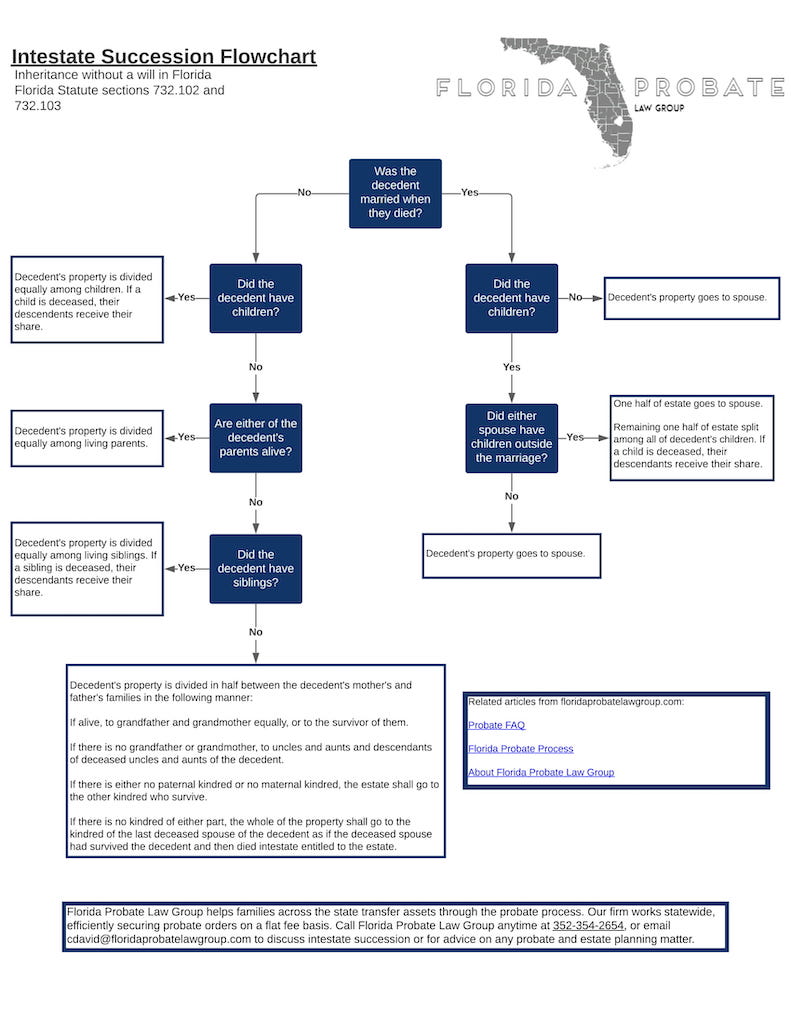

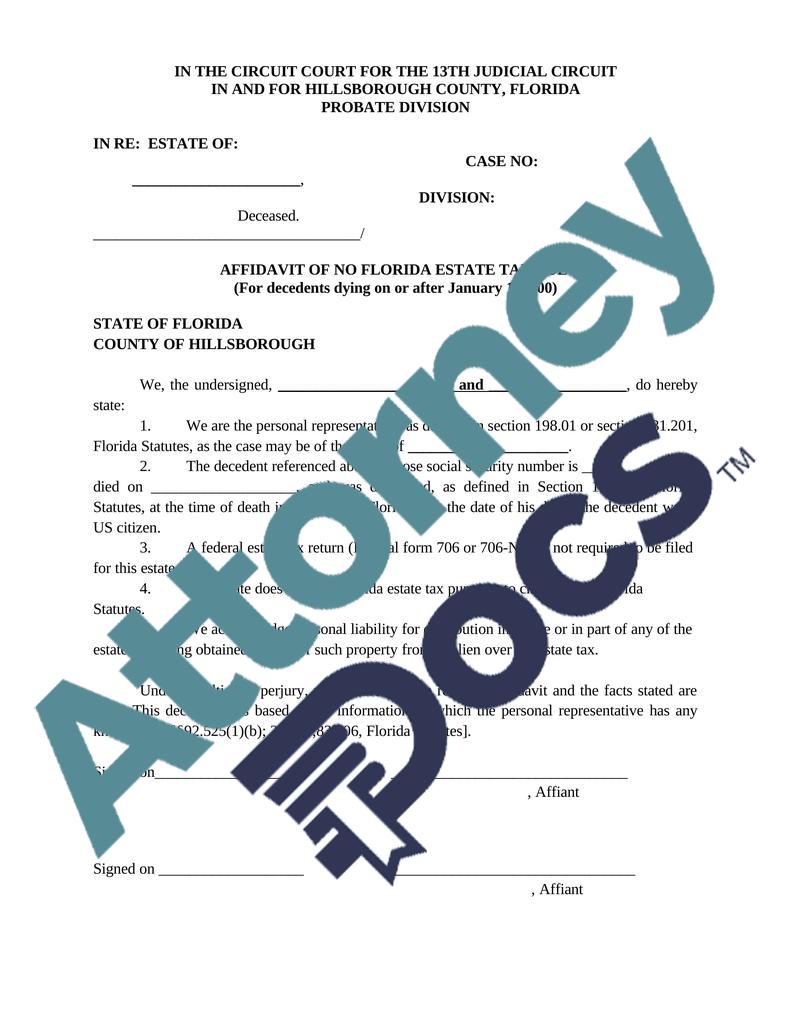

Florida Estate Tax Exemption 2025 - Affidavit of No Florida Estate Tax Due Attorney Docs The Legal, The federal estate tax exemption amount went up again for 2025. A federal change eliminated florida's estate tax after december 31, 2004. Tax Exemption Form For Veterans, Florida tax law changes for 2025. If your estate is worth less than this, you’ll need to pay the federal income.

Affidavit of No Florida Estate Tax Due Attorney Docs The Legal, The federal estate tax exemption amount went up again for 2025. A federal change eliminated florida's estate tax after december 31, 2004.

As announced by the irs, the key 2025 federal transfer tax exemption amounts per taxpayer are as follows: Florida tax law changes for 2025.

The federal estate tax exemption amount went up again for 2025.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, 2025 estate tax exemptions in florida. Citizen, the florida estate tax exemption amount is still $11.4 million.

Recently, the irs announced an increased federal estate tax exemption for 2025.

florida estate tax exemption 2025 Leanne Blue, In 2025, the federal gst tax exemption increased along with the federal gift and estate tax exemption to us$13,610,000 per taxpayer (us$27,220,000 for a married. The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year.

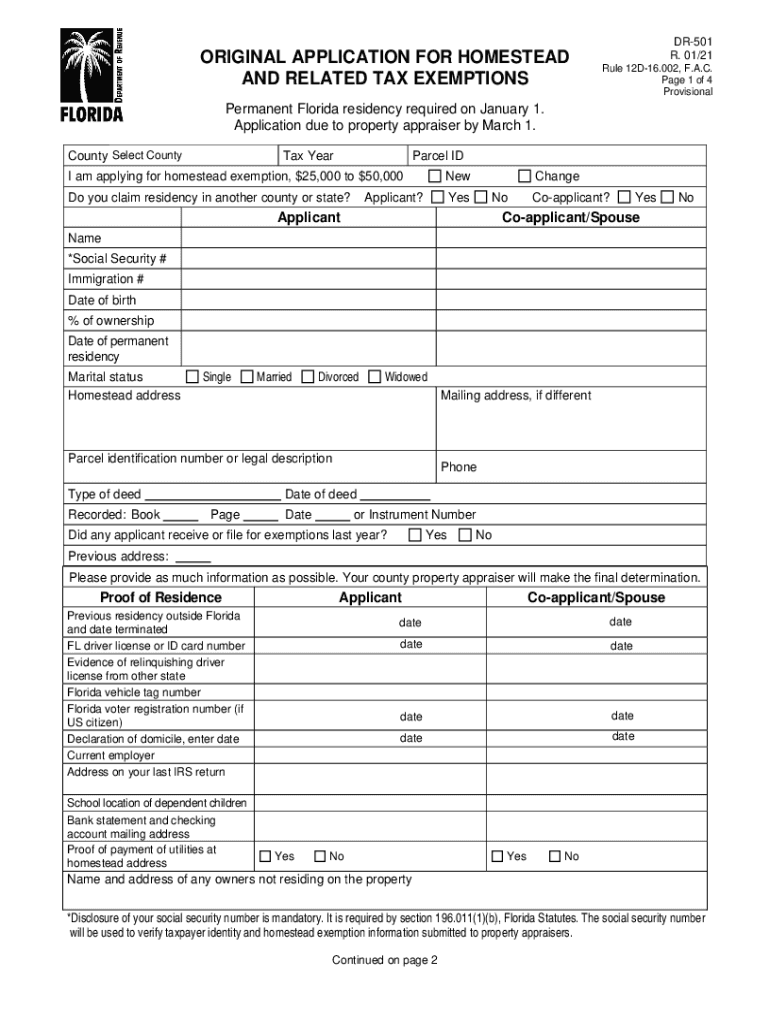

How To File For Florida Homestead Exemption Tutorial Pics, Deadline for establishing your property’s homestead status for the 2025 tax year. Deadline to apply for the homestead tax exemption for the 2025.

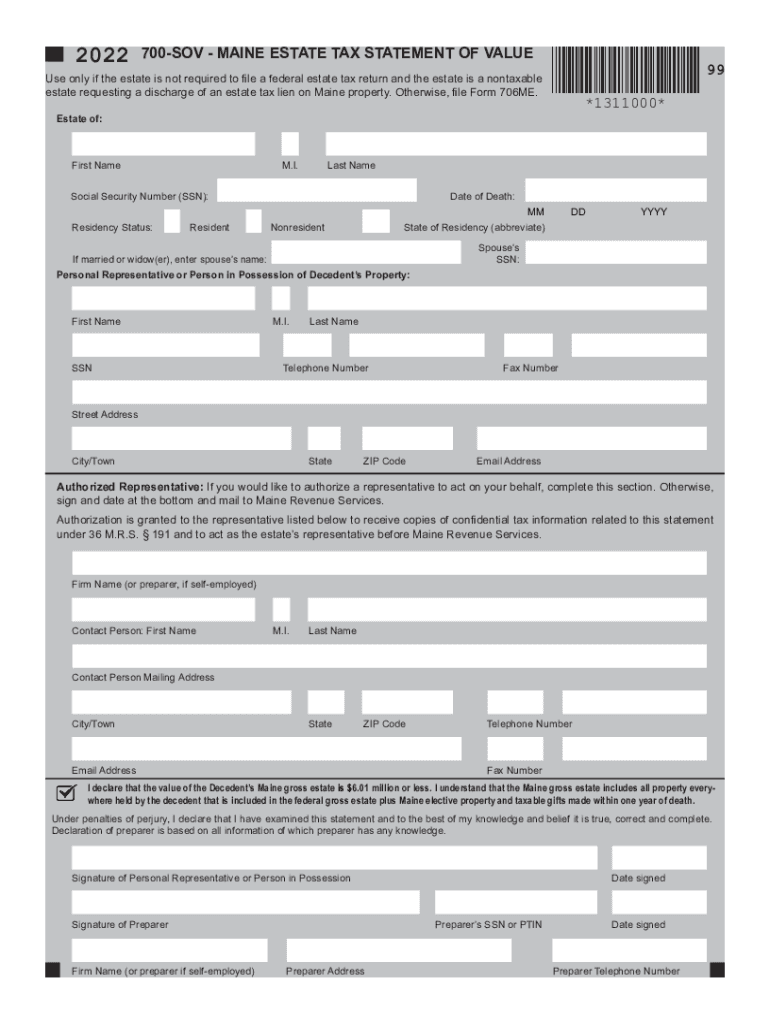

Sov 20252025 Form Fill Out and Sign Printable PDF Template, When an exemption is higher, more estates are exempt from. Deadline for establishing your property’s homestead status for the 2025 tax year.

Estate Tax Exemption Increased for 2023 Anchin, Block & Anchin LLP, This is the dollar amount of taxable gifts that each. Even if you’re a u.s.

Discover The Latest Federal Estate Tax Exemption Increase For 2023, Only the largest estates end up paying the estate tax, as there is a substantial exemption that allows a certain. Recently, the irs announced an increased federal estate tax exemption for 2025.

Florida Estate Tax Exemption 2025. Florida senate bill 102, commonly referred to as the live local act (the act), provides that certain developments will be eligible for a 75 percent or 100. 2025 federal estate tax exemption.