Max 401k Contribution 2025 Including Employer Match - 401k Max Contribution 2025 Employer Match Marge Magdaia, The 401 (k) contribution limit is $23,000. Max 401k Contribution 2025 Including Employer Elana Marita, For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2023.

401k Max Contribution 2025 Employer Match Marge Magdaia, The 401 (k) contribution limit is $23,000.

401k Contribution Limits 2025 With Employer Match Kaile Marilee, The irs limits how much employees and employers.

Max 401k Contribution 2025 Including Employer Naukri Shay Benoite, Employer matches don’t count toward this limit and can be quite generous.

Max 401k Contribution 2025 Including Employer, Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

Max 401k Contribution 2025 Including Employer Match. Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2023 and 2025. $19,500 in 2025 and 2025 and $19,000 in 2025), plus $7,500 in 2023;.

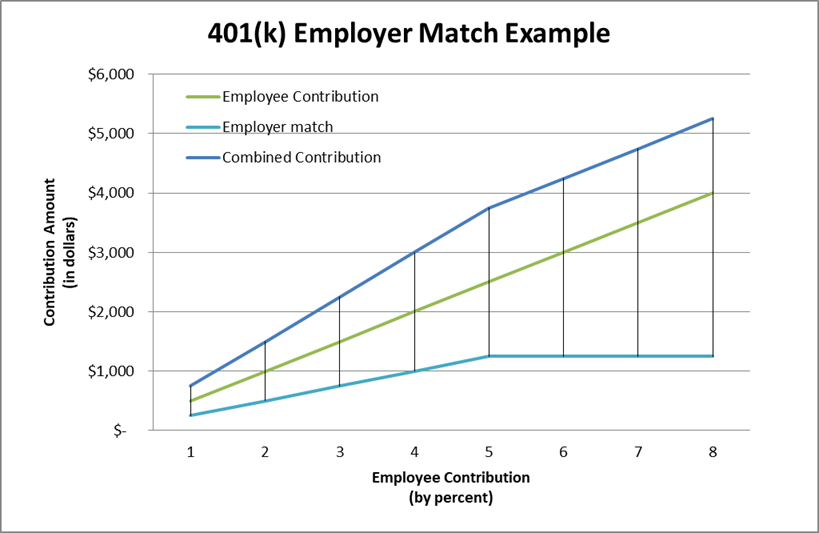

401k Limit 2025 Combined Employer Match Kyle Shandy, Free 401k calculator to plan and estimate a 401k balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

2025 401k Max Contribution Seka Winona, The good news is that these limits do not include employer matches.

401k Max Contribution 2025 Include Employer Match Korry Mildrid, Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

Employer matches don’t count toward this limit and can be quite generous. If you contribute, say, $23,000 toward your 401(k) in 2025 and your employer adds $5,000, you’re still within the irs limits.

Solo 401 K Contribution Limits 2025 Employer Match Letti Olympia, Employer contributions, including matching contributions, count toward the total contribution limit for 401(k)s, which is the combined limit for both employee and.